Ethereum’s recent performance has sparked debate about its long-term prospects in the current market cycle. With questions arising over whether to sell ETH to mitigate further losses or hold onto it in anticipation of future growth, investors are seeking clarity on the best course of action.

Is Now the Right Time to Invest in ETH?

Ethereum has experienced a significant downturn, with its price dropping 57% from $4,100 to $1,750 between December and mid-March. This sharp decline has led to widespread fear among investors, prompting considerable sell-offs, even from the largest holders. The number of addresses with more than 10,000 ETH fell from 999 to 919 between mid-February and early March, a clear indication of reduced confidence from whales.

Additionally, whale activity has further fueled the selling pressure, with at least 130,000 ETH leaving the wallets of major investors in the week leading up to March 17. U.S. spot Ethereum exchange-traded funds (ETFs) have seen outflows of $760 million over the past month, signaling investor skepticism.

Furthermore, between March 11 and 13, traders transferred over 100,000 ETH to crypto exchanges, intensifying the selling momentum.

Analyzing the Technical Outlook

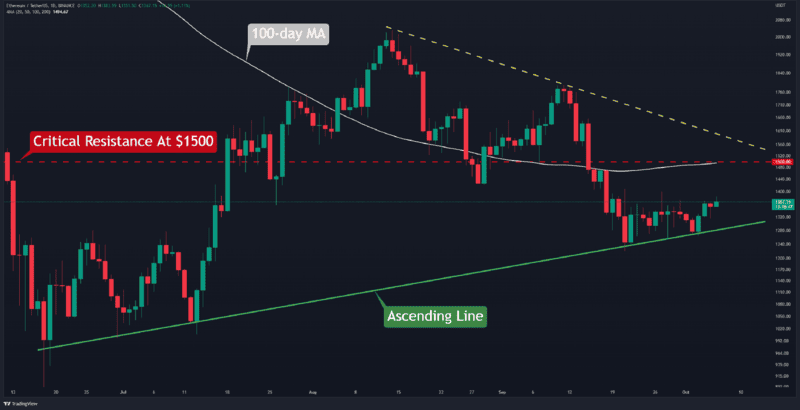

Technically, Ethereum’s three-day chart reveals an ascending triangle pattern, potentially signaling a decline to $1,000. Additionally, a break of the daily chart’s parallel channel suggests that ETH could dip further to the $1,250 level.

Key support levels for ETH have been identified, with $1,440 emerging as a critical downside target. If Ethereum can maintain this support, there could be a chance for a rebound. However, the $1,887 level holds more significance, as it marks the distribution area where 1.63 million ETH have been accumulated by investors.

Should Ethereum fail to hold above $1,887, the price could fall further to levels like $1,440, $1,250, or even $1,000. On the upside, resistance at $2,250 and $2,610 remains significant, and a breakout above these levels could negate the bearish outlook for Ethereum.

Despite the current selling pressure and technical indications of downside risk, recent data suggests a shift in sentiment. Ethereum whales have been accumulating large amounts of ETH, adding 470,000 coins in just the past week. Additionally, over the past 48 days, more than 1.2 million ETH have been withdrawn from exchanges, signaling a reduction in available supply and a potential upward shift in price dynamics.

With a growing amount of ETH leaving exchanges and major investors increasing their positions, the market could be poised for upward momentum in the near future.