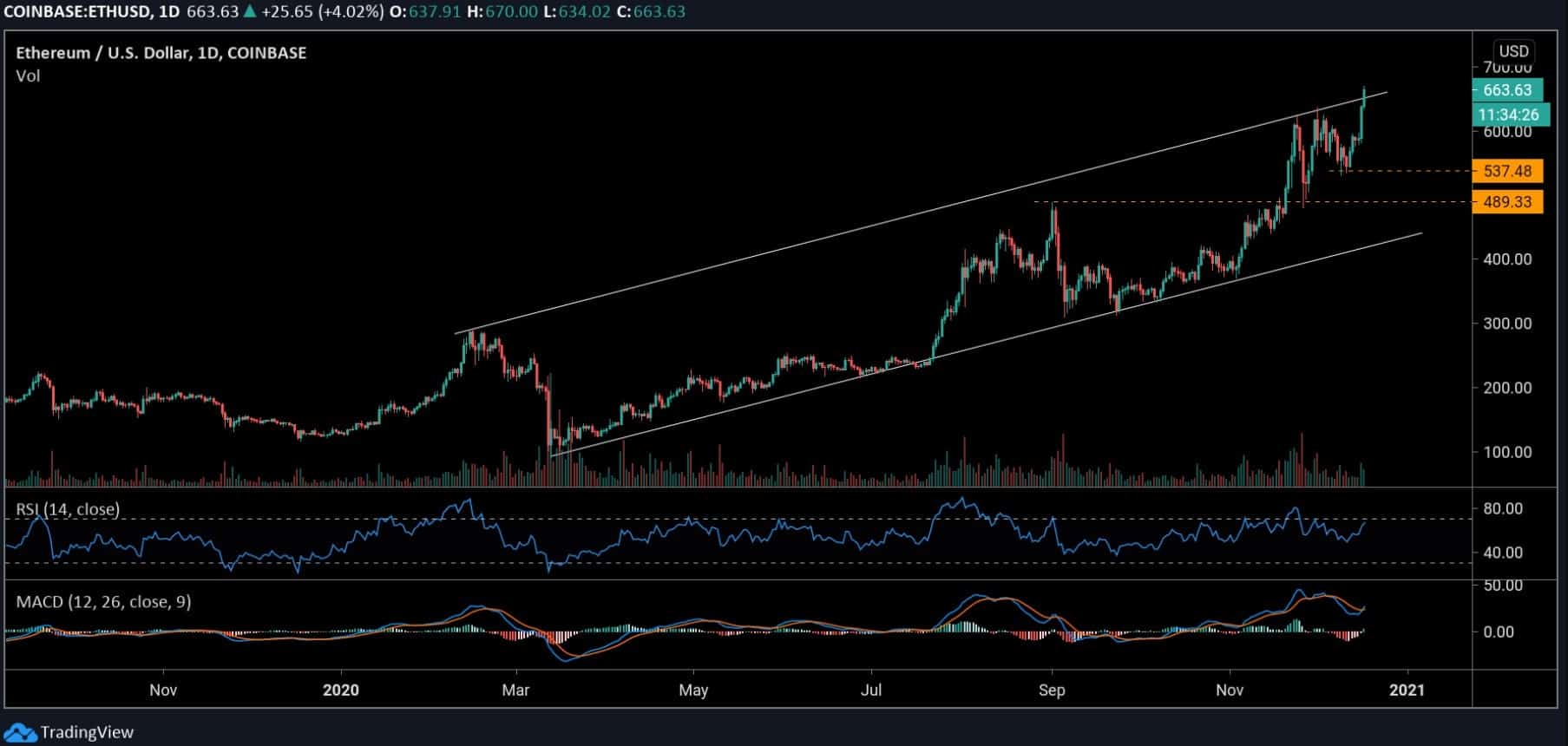

After Bitcoin’s rise, Ethereum resumed its bullish momentum, recording an impressive 18% increase over the past week. It surged to a new yearly high, currently trading around $666, marking a 12% overnight gain. As of now, Ethereum’s market capitalization stands at approximately $75 billion. This is the highest price Ethereum has seen since May 2018. Given this, it is evident that the bulls have taken control. The price has broken away from its previous ascending channel, signaling the beginning of a new rally. If this bullish surge continues, Ethereum is likely to reach even higher levels.

If the bulls continue pushing, the next target appears to be around $700, although the $680 level might present some resistance. Beyond $700, the next resistance levels are $720 and $750. Should Ethereum face a pullback, the recently broken resistance at $636 will act as the first support level. If this fails to hold, the next key support is at $600. Below that, further support is found at $537 and $489, where the price previously began to bounce.

Against Bitcoin, Ethereum has faced significant difficulties. Yesterday, it fell below the 0.03 BTC support level, which had previously contained bearish pressure for the past few weeks. Today, the price dipped further, reaching 0.027 BTC before recovering slightly to 0.0293 BTC. Despite this decline, the long-term outlook for Ethereum remains bullish. However, if the price continues to drop, especially below the ascending trend line, the trend could lose its momentum. A recovery above the critical 0.030 BTC level would likely restore bullish sentiment, but the bears are currently asserting dominance.

As noted, the 0.030 BTC level remains a critical resistance point for Ethereum’s recovery. If the price climbs above this level, the next significant resistances to watch are 0.0337 BTC, 0.0371 BTC, and 0.041 BTC. On the downside, Ethereum recently faced rejection at the 0.027 BTC level. If the price drops further, the next support levels to monitor are 0.0263 BTC, just below the ascending trend line, followed by 0.024 BTC.