Ethereum, like many other large-cap cryptocurrencies, is trading near long-term support levels, a situation that remains precarious. The uncertainty surrounding the broader market, particularly in relation to Federal Reserve decisions, is affecting investor sentiment. Notably, trading volumes on significant US-based exchanges like Binance US and Coinbase are still relatively low, indicating that many investors are waiting for clearer direction before committing to any major positions.

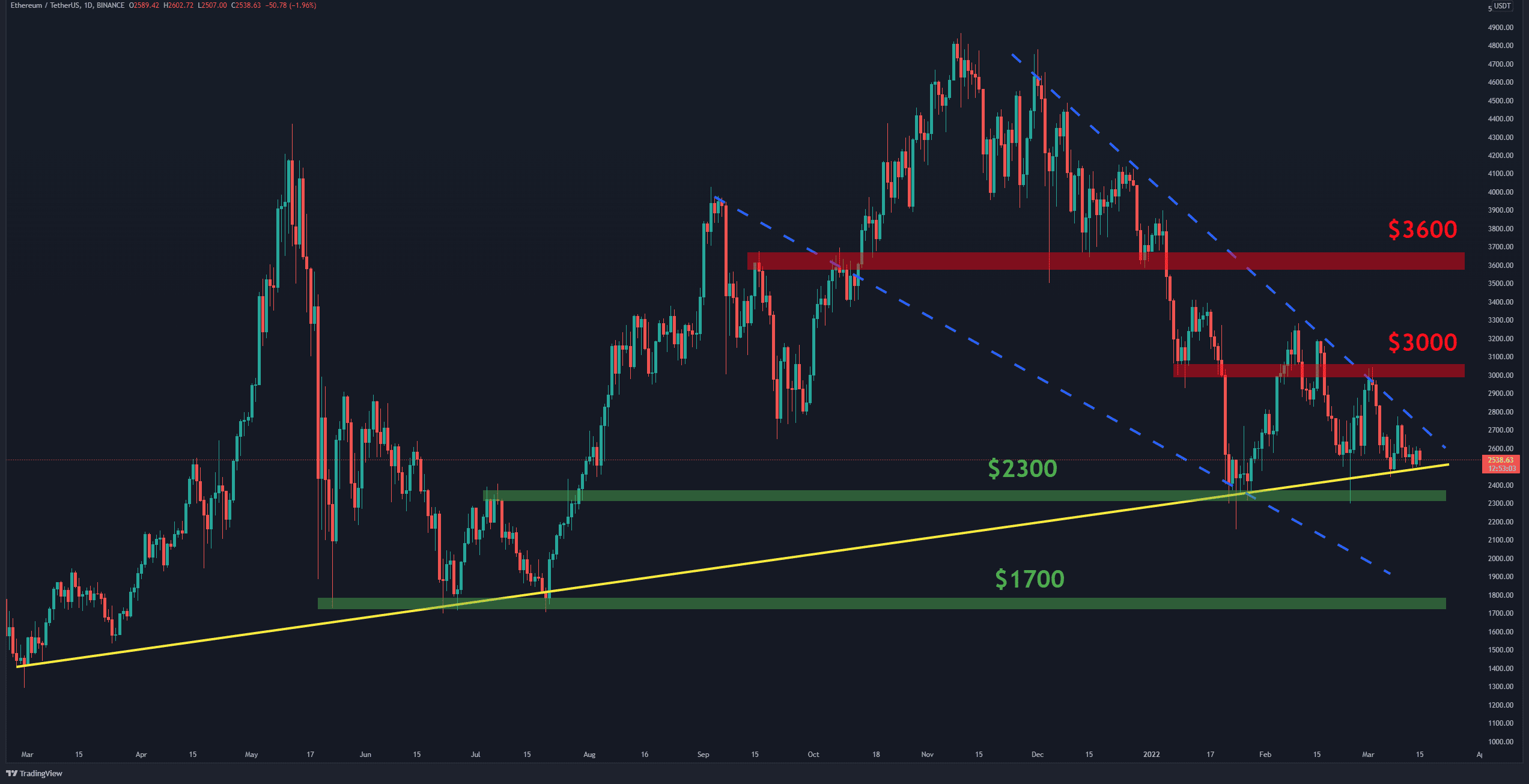

On the daily chart, Ethereum is sitting on top of its dynamic support. However, the price is still moving downward within a falling wedge pattern. This suggests that Ethereum is nearing a critical juncture, with a breakout or breakdown on the horizon.

From a bullish perspective, Ethereum must break above the resistance at $2650 to signal that upward momentum could continue. A subsequent move above $3000 would confirm a higher high and likely encourage more buyers. On the flip side, a failure to hold the support could result in a breakdown below $2300, potentially pushing the price to sub-$2K levels.

On the 4-hour chart, Ethereum is currently trading just above its short-term support level. The price is also trading below the MA-50 and MA-100 moving averages, which have been acting as resistance over the past week. For the bulls to regain control, Ethereum must break above the $2650 zone, where the MA-50 and MA-100 lines converge.

The RSI-14 is currently below its downtrend line and the baseline, showing that bears still have the upper hand. However, if the price can break above $2650, the RSI may also turn bullish, potentially leading to further gains.

The market remains uncertain, with many investors waiting for the outcome of the upcoming Federal Reserve meeting, which is expected to provide guidance on interest rate decisions. In addition, the ongoing geopolitical concerns, particularly regarding the Russia-Ukraine conflict, continue to add volatility to the broader financial markets, making Ethereum’s price action highly sensitive to these external factors.

Ethereum is at a pivotal point. If the price can break key resistance levels, it could signal the start of a new bullish trend. However, a failure to hold current support could lead to further downside. As always, external factors such as Federal Reserve decisions and global economic concerns will play a significant role in determining Ethereum’s future price action.