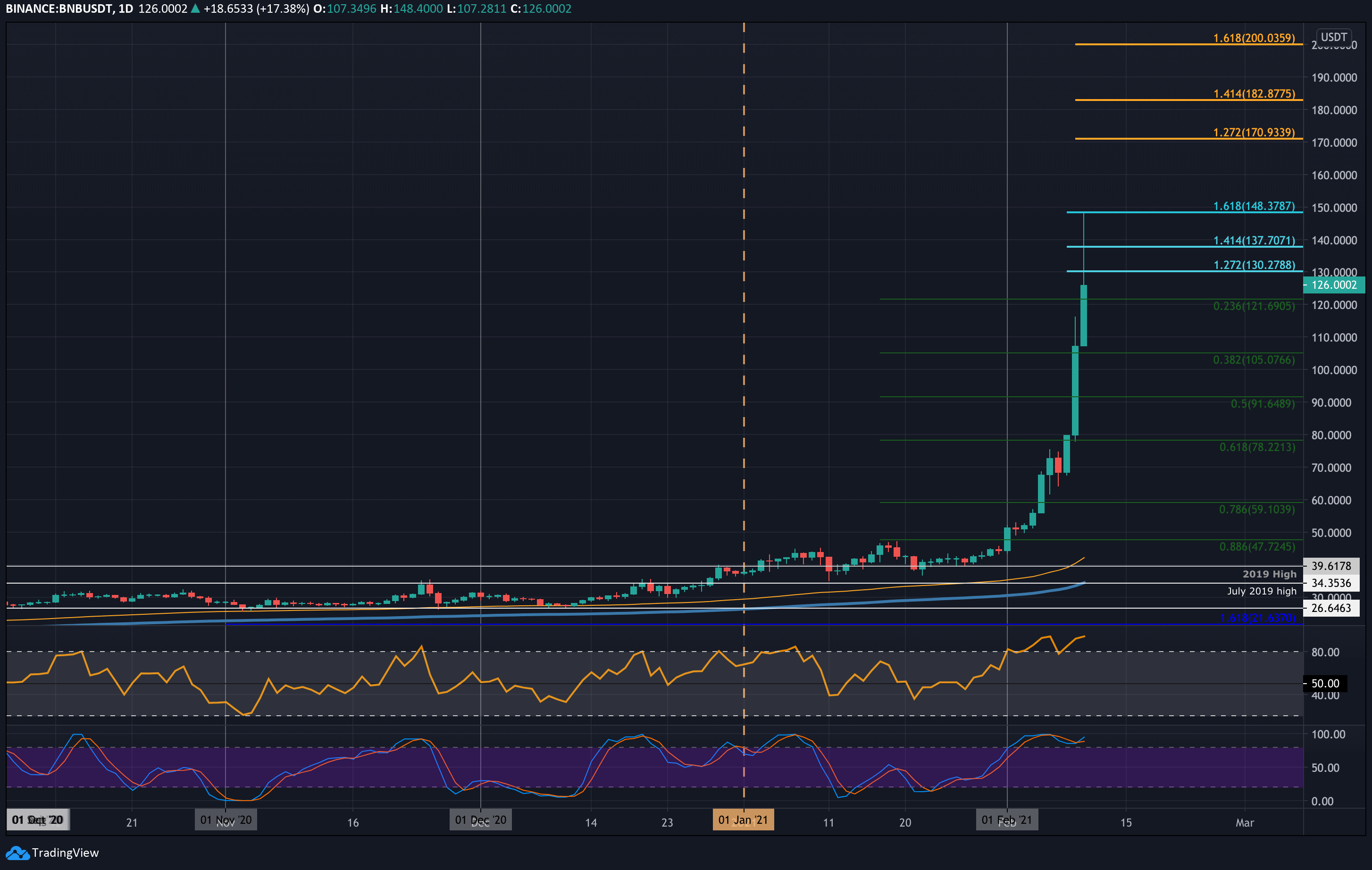

Binance Coin has seen a remarkable 33.5% price surge today, pushing its value to a new all-time high (ATH) of $148.37. BNB has been on a parabolic run, climbing 149% this week alone. Binance Coin was trading at just $50 a few days ago before it broke past $80 on Monday. From there, it continued to accelerate, reaching $100 and eventually smashing through the previous ATH to set a fresh record at $148.37, aided by a 1.618 Fib extension.

BNB has advanced in rank and is now positioned 7th in the market with a market capitalization of $8.5 billion, signaling both impressive growth and renewed investor interest.

Looking ahead, the immediate resistance is at $130, followed by $137.70 (1.414 Fib Extension) and the current ATH at $148.37. Should BNB push beyond $150, resistance can be found at $160, $170.94 (1.272 Fib Extension), and $182.87 (1.414 Fib Extension).

Support levels are located at $110, $105 (0.382 Fib), and $100. If the price retraces, further support can be found at $91.65 (0.5 Fib) and $78.22 (0.618 Fib).

Despite the surge, the Relative Strength Index (RSI) has entered overbought territory, indicating that the bullish momentum may be nearing exhaustion in the short term.

Against Bitcoin (BTC), Binance Coin has shown impressive recovery. After a prolonged decline in Q4 2020, where BNB fell from 0.0022 BTC to a low of 0.00123 BTC, it started gaining momentum in February. Yesterday, BNB surged above the 200-day EMA and 0.002 BTC, continuing the upward movement into today. The coin surpassed the 2018 highs at 0.00265 BTC and reached the September 2020 highs at 0.00316 BTC. However, the price has since pulled back slightly, trading around 0.00278 BTC.

Looking forward, resistance is first found at 0.003 BTC, followed by the September 2020 high at 0.00316 BTC. Additional resistance lies at 0.0034 BTC (1.272 Fib Extension), 0.00353 BTC (1.414 Fib Extension), and 0.00371 BTC (1.618 Fib Extension).

Support levels include 0.00265 BTC (2018 High), 0.0024 BTC (0.382 Fib), and 0.00216 BTC (0.5 Fib). If the price continues to retrace, further support may come in at 0.002 BTC.

As with the USD pair, the RSI for BNB/BTC is also entering overbought conditions, signaling that the bulls may be running out of steam for the time being.

Binance Coin’s extraordinary price growth has propelled it to new highs in both USD and BTC pairs. With a 33.5% surge today and 149% growth this week, BNB is clearly benefitting from renewed investor enthusiasm. However, with RSI indicators showing overbought conditions, a short-term consolidation or pullback may be on the horizon. Traders should monitor support and resistance levels closely as BNB navigates these key price points.