Bitcoin has experienced a notable 13% increase from its low of $34,760 yesterday. After a drop from $37,400 on Saturday, the leading cryptocurrency found support and began its recovery. In recent days, Bitcoin struggled to break the $36,000 level, but that changed with a tweet.

Elon Musk, once again, stirred market fluctuations with a tweet suggesting that Tesla might resume accepting Bitcoin. Following this tweet, Bitcoin managed to break through the resistance at $38,000, which had been limiting the market since the capitulation event in mid-May. BTC had attempted to break this trendline three times previously without success.

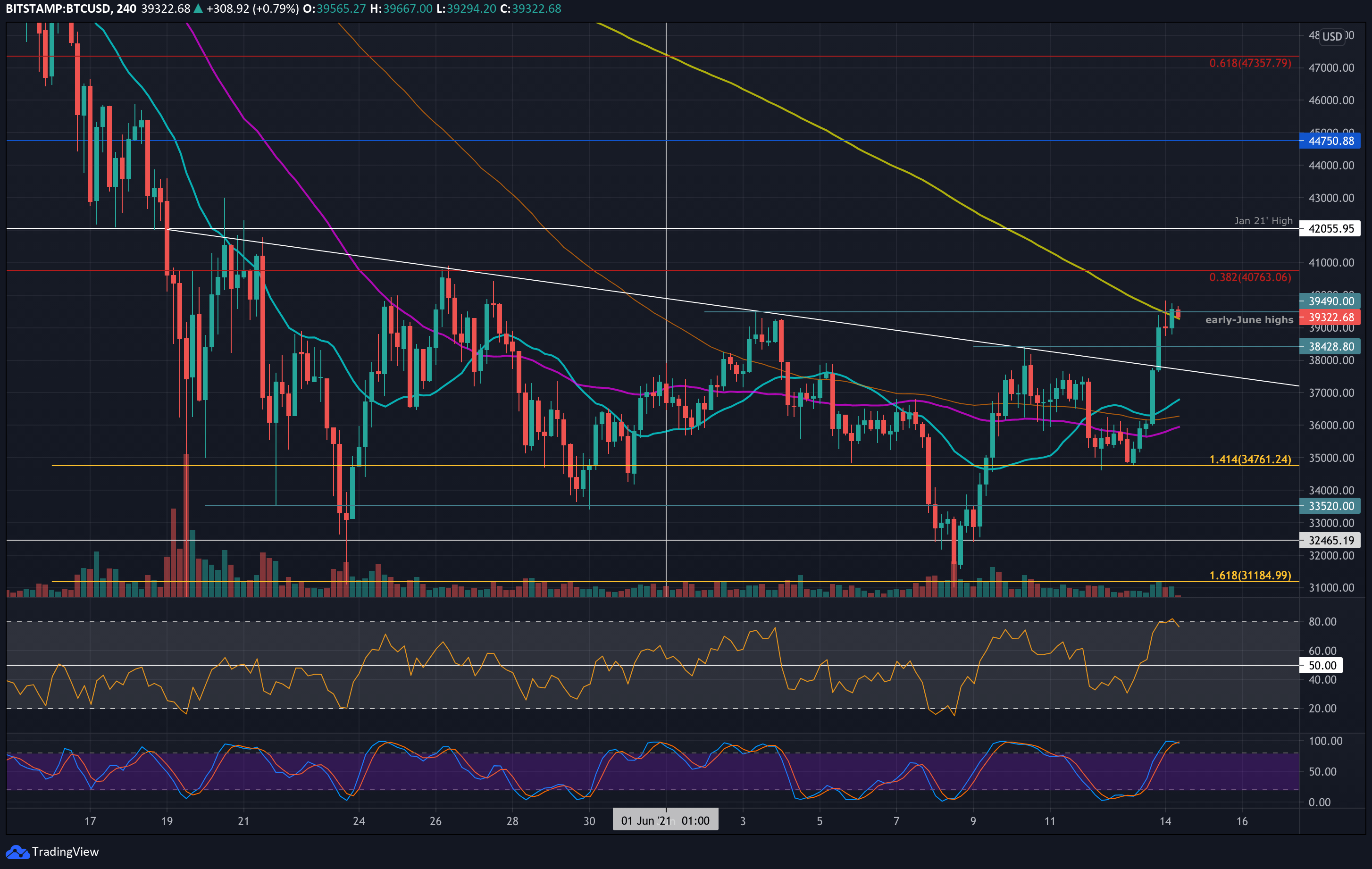

Yesterday’s daily candle closed above this trendline, confirming the breakout. Today, Bitcoin surged to $39,840, setting a new high for June 2021. This breakout came just three days after a Morning Star reversal pattern, which we discussed in an earlier analysis. However, it is crucial to recognize that Bitcoin still faces significant resistance around the $42,500 mark, where the 200-day moving average lies.

Today’s price movement allowed Bitcoin to set its first higher high since the recent market downturn. The next step for the bulls is to secure a higher low above $39,200 in order to break the pattern of lower highs that has been in place since early June.

Currently, the focus shifts to the $42,000 to $42,500 range, as it represents the next key area for Bitcoin’s potential recovery.

Looking ahead, the first resistance lies at $40,000. Next, resistance is found at $40,760 (bearish .382 Fibonacci retracement), $42,000 (January 2021 highs), $42,500 (200-day moving average), and $44,700 (50-day moving average). Additional resistance is seen at $46,000 and $47,360 (bearish .618 Fibonacci).

On the downside, the first level of support is $39,200 (previous local high), followed by $38,000, $36,750, $36,000, and $34,760.

The RSI has moved cleanly above the midline for the first time since May 10th, indicating that the bulls are regaining control. However, the 4-hour RSI suggests that the market might be overbought, signaling the possibility of a short-term retracement.