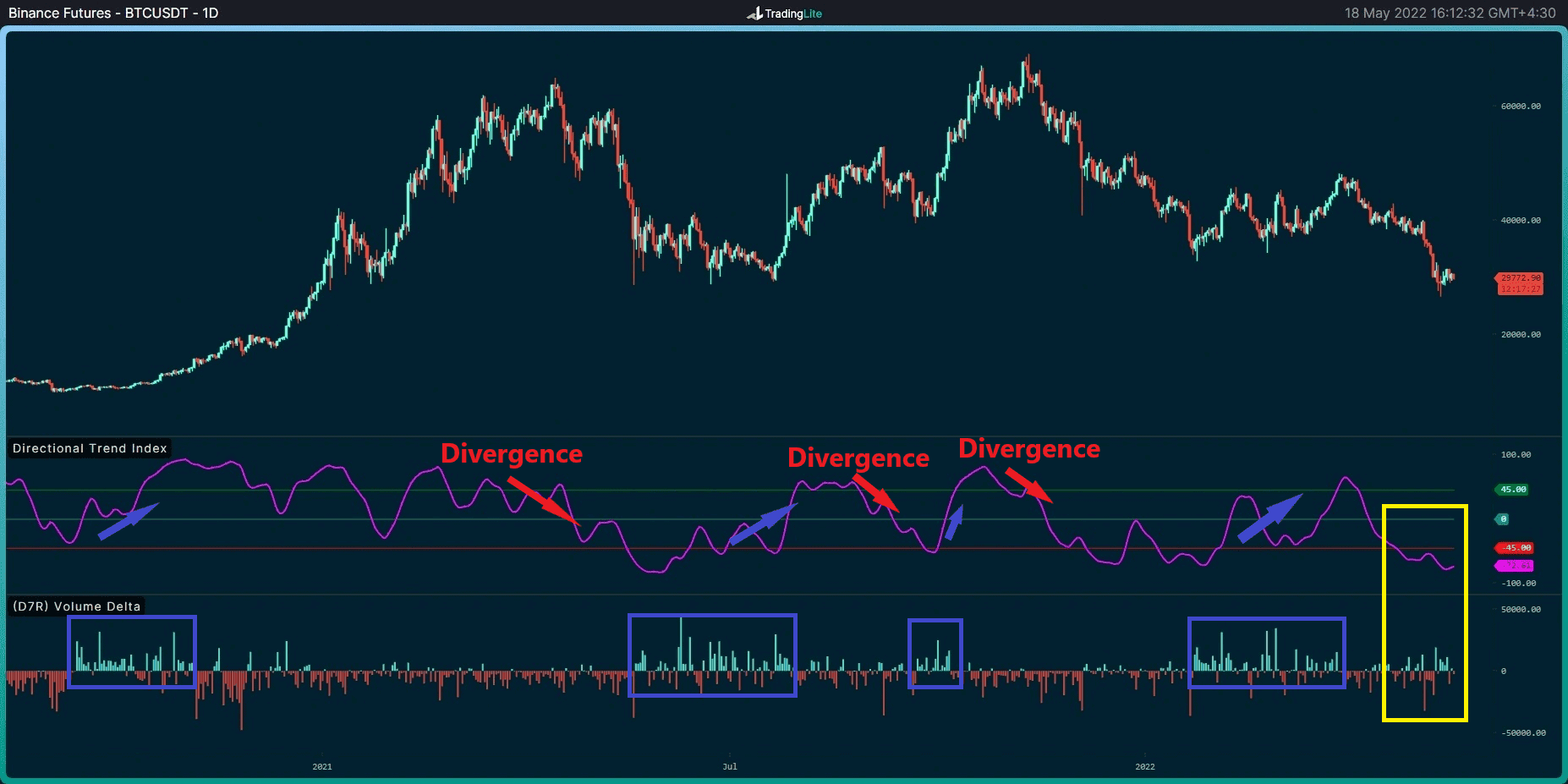

Bitcoin has experienced a significant uptrend over the past week, starting with a sharp V-shaped rebound from the 200-day moving average, which is positioned around the $20K region. This was followed by a decisive breakout above the $25K resistance level.

Currently, Bitcoin is approaching the critical $30K zone, a key mid-term resistance. If the price manages to break through this level, it could signal the beginning of a bullish trend in the coming months.

That said, the RSI has now entered the overbought zone, suggesting that a short-term pullback or consolidation may occur. In this case, the $25K level could act as support and be retested.

Bitcoin’s 4-Hour Chart: Bullish Momentum Faces Potential Consolidation

On the 4-hour chart, Bitcoin has experienced a nearly vertical rise. After breaking above the $25K resistance, the price briefly retested this level before continuing its ascent.

Although the market structure remains bullish on this timeframe, there is still a possibility of a consolidation phase or pullback. The 4-hour RSI shows a noticeable bearish divergence, indicating that recent price highs may not be sustainable. While the $25K level is expected to offer support, a deeper pullback could bring the price down to test the $23K level.

Despite this potential short-term correction, both the daily and 4-hour charts suggest that Bitcoin could soon reach the $30K area for the first time in nearly a year. The pullback, if it occurs, could be delayed until the price reaches this resistance level.

On-Chain Analysis: Monitoring Exchange Reserves Amid Price Surge

Bitcoin’s recent surge has sparked a strong uptrend, with significant price increases attracting attention from retail investors. Some of these participants may view the recent rally as an opportunity to take profits and manage risk.

Bitcoin’s Exchange Reserves metric declined prior to the surge above the $25K level. Since the breakout, the metric has slightly risen, indicating that more Bitcoin is being sent to exchanges, likely for selling purposes. This shift in behavior should be closely monitored in the coming days to gauge the market’s next move.