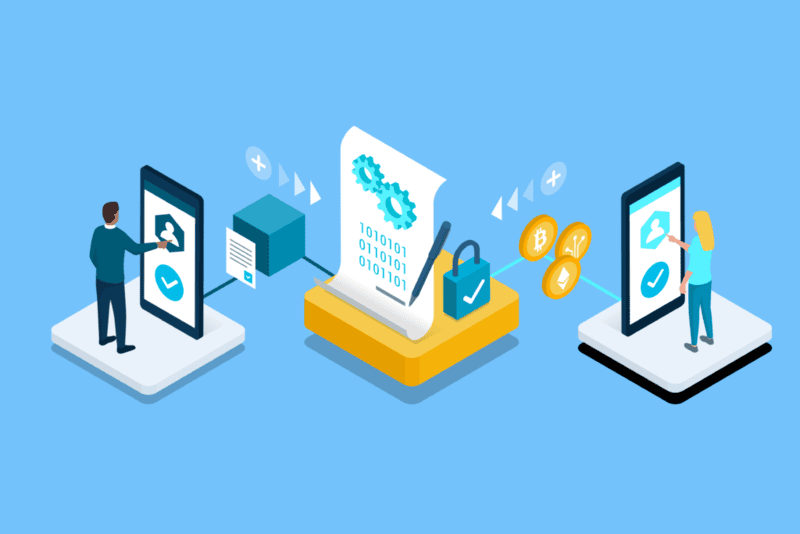

Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. They are integral components of blockchain technology, enabling decentralized applications (dApps) to execute predefined actions once specific conditions are met. Smart contracts eliminate the need for intermediaries, ensuring transparency, security, and efficiency.

While smart contracts are often associated with blockchain platforms like Ethereum, their applications go far beyond cryptocurrency transactions. In this post, we will explore the different types of smart contracts, their uses, and the specific features that differentiate them from one another.

What Are Smart Contracts?

At their core, smart contracts are a form of digital agreement stored on a blockchain. They allow two or more parties to automatically execute, verify, or enforce a contract’s terms without relying on a third-party intermediary. Once the contract conditions are met, the smart contract autonomously executes the agreed-upon actions, making them secure, transparent, and tamper-proof.

These contracts are often written in programming languages such as Solidity, Vyper, or Rust, depending on the blockchain platform. Ethereum remains the most widely used platform for smart contract deployment due to its extensive ecosystem, but there are also other notable platforms like Binance Smart Chain, Polkadot, and Cardano that support smart contracts.

Types of Smart Contracts

There are several types of smart contracts, each designed to serve different purposes within the blockchain ecosystem. Below, we will break down the most prominent types of smart contracts and their common use cases.

1. Basic Smart Contracts

These are the most straightforward type of smart contracts. They are usually designed to perform a single action or function based on a specified condition.

Use Cases:

- Token Transfer: When a specific condition is met (e.g., a transfer request), a basic smart contract can execute the transfer of tokens between parties.

- Escrow Services: In an escrow contract, the contract executes a transfer of assets (such as cryptocurrency or tokens) once both parties fulfill the agreed terms (e.g., when a product is delivered, the payment is automatically released).

2. Multisignature (Multisig) Smart Contracts

Multisignature smart contracts require multiple parties to sign off on a transaction before it can be executed. This is useful in cases where a single party should not have full control over a particular transaction or action.

Use Cases:

- Governance and Treasury Control: Multisig contracts are often used in decentralized organizations (DAOs) to control access to funds or governance votes. For example, several key members of an organization must approve a fund transfer before it occurs.

- Crypto Wallets: A multisig smart contract is often used to secure a crypto wallet, where multiple private keys are needed to sign a transaction before it’s processed.

3. Decentralized Finance (DeFi) Smart Contracts

DeFi smart contracts are specifically designed to facilitate financial transactions without intermediaries. These contracts power applications like decentralized exchanges (DEXs), lending platforms, and synthetic assets.

Use Cases:

- Automated Market Makers (AMMs): DeFi exchanges like Uniswap and SushiSwap use smart contracts to automate the buying and selling of tokens without relying on traditional order books or centralized matching engines.

- Lending and Borrowing: Smart contracts in platforms like Aave or Compound enable users to lend and borrow assets without intermediaries. When a user deposits collateral, the smart contract verifies the terms of the loan, including the interest rate and repayment conditions.

4. Oracle-Based Smart Contracts

Oracles are external data sources that provide real-world information to blockchain networks. Smart contracts that utilize oracles can trigger actions based on external data, such as price feeds, weather conditions, or stock market prices.

Use Cases:

- Prediction Markets: In prediction markets (e.g., Augur), smart contracts use oracles to determine the outcome of a prediction based on real-world events, such as sports results or political elections.

- Insurance: Smart contracts that use oracles can automate insurance claims. For instance, if a flight is delayed (tracked through an oracle), an insurance claim can be automatically triggered and processed.

5. Non-Fungible Token (NFT) Smart Contracts

NFTs are unique digital assets that represent ownership or proof of authenticity of a specific item, asset, or piece of content, typically within the digital art or gaming sector. NFT smart contracts encode information about the unique asset, including ownership, provenance, and any embedded royalties or conditions for future transactions.

Use Cases:

- Digital Art: Artists can issue their work as NFTs, where the smart contract contains the terms of ownership and resale royalties. Whenever the NFT is resold, a portion of the sale price can automatically be sent back to the creator.

- Gaming: In blockchain-based games, NFT smart contracts manage ownership of in-game assets like weapons, skins, and collectibles.

6. Self-Executing Legal Contracts

These smart contracts are designed to handle more complex legal agreements, automating the execution of contracts between parties based on predefined terms. Unlike traditional legal contracts, these are self-executing, and their terms are written directly into the code.

Use Cases:

- Supply Chain Agreements: A smart contract in supply chain management can ensure that payments are made automatically when specific conditions (e.g., delivery verification) are met, reducing the need for manual intervention and increasing efficiency.

- Real Estate Transactions: Smart contracts can facilitate property sales by automating the process of transferring ownership once all conditions of the agreement (e.g., payment, inspections, etc.) are fulfilled.

7. Tokenized Asset Smart Contracts

These contracts are used to create and manage tokenized representations of real-world assets such as real estate, commodities, or equities. Tokenized assets are digital representations of physical or financial assets, which can be easily traded on blockchain platforms.

Use Cases:

- Real Estate Tokenization: Smart contracts are used to tokenize real estate assets, allowing them to be divided into smaller portions that can be traded on blockchain platforms. These contracts manage the ownership, transfer, and settlement of these tokenized properties.

- Commodity Trading: Tokenized commodities such as gold or oil can be traded and settled using smart contracts, enabling faster, more secure transactions with fewer intermediaries.

Smart contracts are the backbone of decentralized applications and blockchain ecosystems. From basic token transfers to complex legal agreements, the versatility and efficiency of smart contracts are driving innovation across a wide range of industries. While the use cases we discussed here are just the tip of the iceberg, they demonstrate the potential of smart contracts to reshape traditional systems and provide a foundation for the future of decentralized services and applications.