After breaking June 2019’s 15-month high just four days ago, Bitcoin is approaching a critical zone, eyeing a new high not seen since January 2018.

As of the latest updates, the first U.S. election results are beginning to pour in, and Bitcoin is exhibiting behavior similar to that seen during the 2016 elections surging by 3% over the past 24 hours.

Currently trading around the $14K mark, Bitcoin has surged more than $400 in just the past two hours, signaling its ongoing bullish momentum.

Similar Setup to 2016 U.S. Elections?

As U.S. election data starts to accumulate, Bitcoin is living up to its reputation as one of the most volatile assets in the market.

Back in 2016, when Donald Trump was elected, Bitcoin experienced a surge while Asian stock markets crashed. Although the situation is different now, similar volatility in both directions is to be expected.

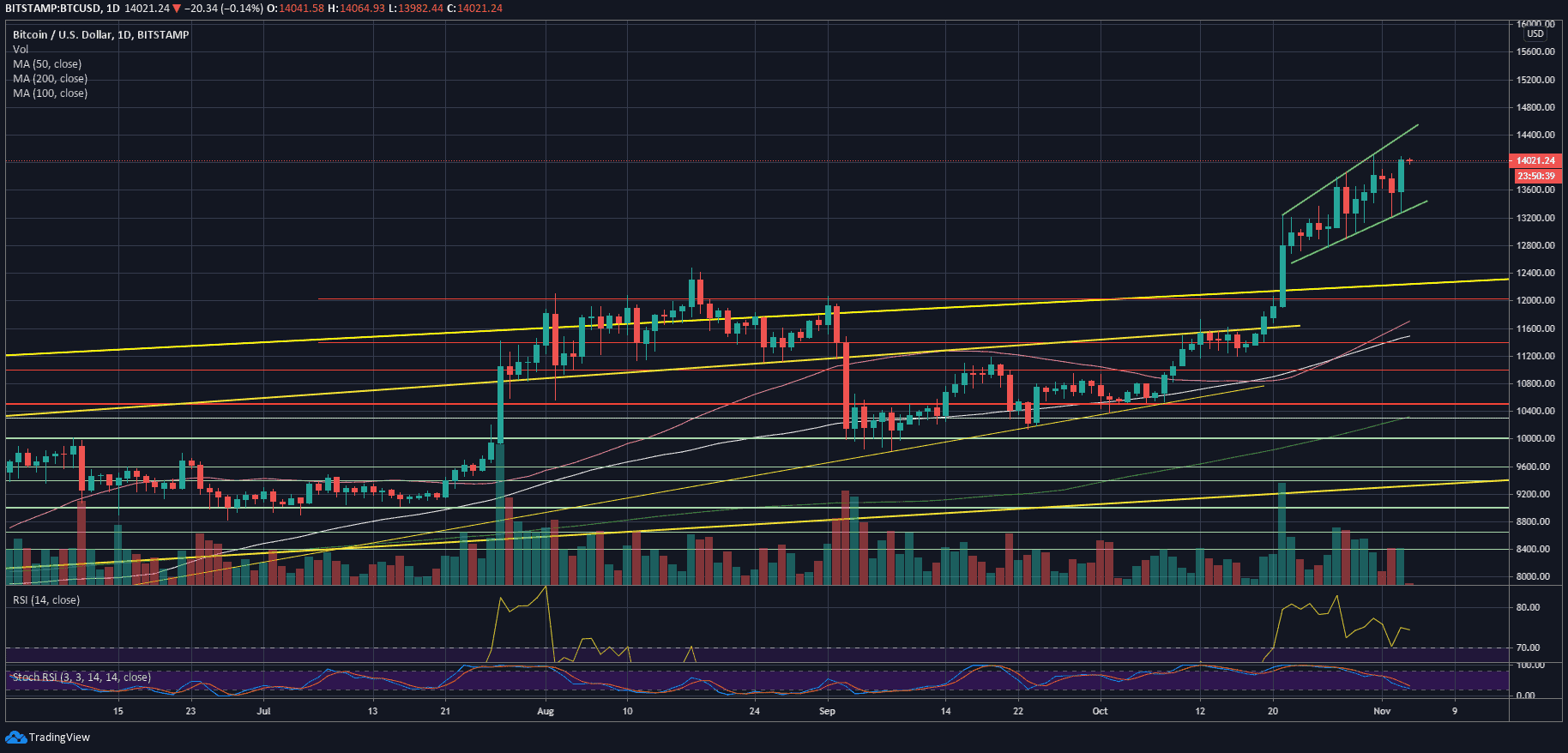

The daily chart shows that almost every candlestick over the past week has featured a significant wick, indicating strong buying interest during price dips. However, despite this bullish behavior, the RSI indicator on the daily chart still shows signs of bearish divergence. This divergence is slowly being invalidated, as reflected in the 4-hour chart, suggesting that the bullish momentum may continue.

At present, the $13,800 to $14,000 zone serves as the last significant barrier for Bitcoin. This range contains the previous June 2019 high of $13,870 and the monthly closes from the 2017 bubble peak in December 2017 and January 2018. Bitcoin was rejected at this level once (on Saturday), and overcoming it would be critical for further price appreciation.

Bitcoin Support and Resistance Levels to Watch

- Resistance Levels:

- The immediate resistance lies between $14,000 and $14,100, a key zone marked by the previous 1000-day high set last Saturday.

- If Bitcoin breaks through this resistance, there is limited resistance ahead until the all-time high, as Bitcoin traded above this range for only a few days.

- The first key resistance above $14,100 is at $14,500, followed by the psychological level at $15,000.

- Support Levels:

- The first major support is in the $13,800 to $13,870 range, which previously acted as resistance.

- A breakdown below this level could bring Bitcoin to the next support zone, around the ascending trend-line near $13,350.

- Further down, the $12,800 support area offers additional backing for the price.

Bitcoin’s ongoing volatility is closely tied to the uncertain outcomes of the U.S. elections, and the asset is in a crucial phase of price action. Key levels to watch in the coming days include the $14,000 to $14,100 resistance zone and the support around $13,800-$13,870. Whether Bitcoin can push past these barriers will determine the direction of its next move.