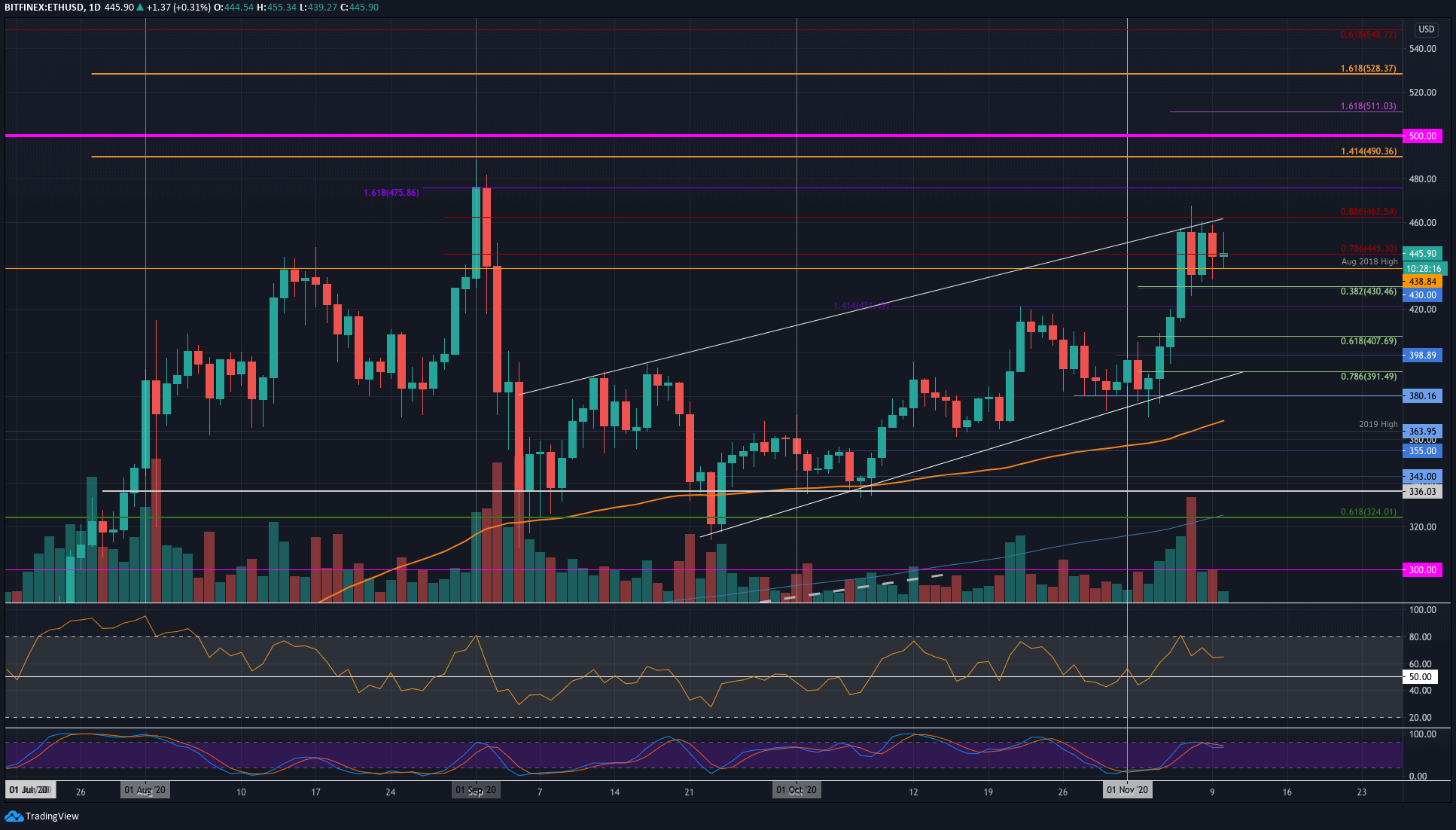

Ethereum has been consolidating over the past five days, struggling to close a daily candle above the critical $456 resistance level. The price is currently testing the upper boundary of a rising price channel. A breakout above $462.50 could signal the start of a strong bullish rally, potentially targeting new highs in the weeks to come.

Last Friday, Ethereum surged to $456 but was met with immediate resistance, failing to close above this crucial level. Over the weekend, it traded sideways within the $456–$435 range, finding support at $438, a level aligned with the August 2018 highs. If buyers manage to break through $456, the next resistance lies at $462, corresponding to the bearish .886 Fib retracement. Beyond that, Ethereum could aim for $475 (the September high-day closing price), $490 (1.414 Fib extension), and $500, a key psychological and technical milestone.

On the downside, initial support rests at $438, followed by $430 (.382 Fib retracement). Additional levels to monitor include $421 and $407 (.618 Fib retracement).

Technical indicators are mixed but slightly favor the bulls. The RSI remains above the mid-line, showing buyers still have control, while the Stochastic RSI is nearing a bearish crossover, hinting at potential consolidation or a pullback.

Against Bitcoin, Ethereum continues to face challenges around the 200-day EMA at approximately 0.0295 BTC. Support remains at 0.0267 BTC (downside 1.272 Fib extension), but the bulls have yet to overcome the 200-day EMA, which has proven to be a strong resistance point. If Ethereum can close above the EMA, it could target 0.03 BTC, followed by 0.0305 BTC and 0.032 BTC. On the downside, support levels to watch are 0.029 BTC, 0.0284 BTC (February 2020 highs), and 0.0278 BTC.

Looking ahead, Ethereum is expected to gain momentum if it breaks above $462.50. Historical patterns and market sentiment suggest that a rally above $500 could occur by late November, driven by renewed investor confidence and increased activity in the broader cryptocurrency market.