Ethereum’s price has recently surged, breaking out from a multi-month symmetrical triangle pattern. However, momentum has slowed, and after this pullback, Ethereum is now testing the upper trendline of the triangle, which is an essential support level.

If Ethereum successfully retests the upper trendline around $1.5K, this may indicate a pullback to confirm the breakout, allowing the price to continue rising. However, if the price dips below this trendline, the next support zone could be around the $1,350 level.

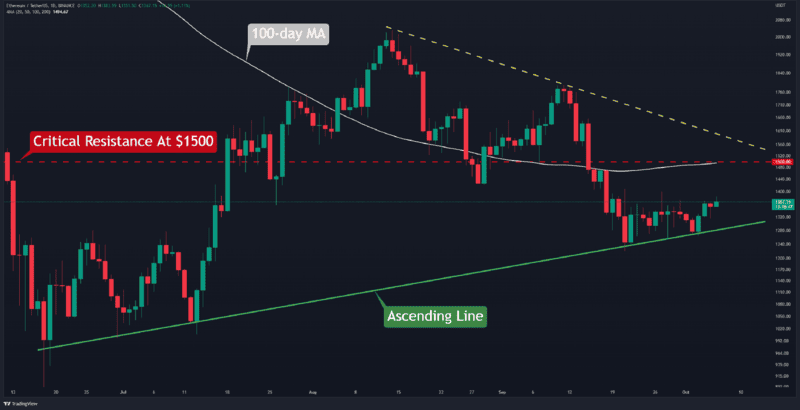

The 4-Hour Chart

On the 4-hour chart, Ethereum is dealing with three key price regions: $1,700 as resistance and $1,350 and $1,150 as supports. The price has been oscillating between $1,700 and $1,350, and it might remain in this range in the short term.

Additionally, the 0.618 Fibonacci level ($1,319) and the 0.5 Fibonacci level ($1,394) from the recent rally align closely with the $1,350 support. This confluence makes $1,350 a critical area for Ethereum. As a result, the price might consolidate near this support level before potentially moving higher.

On-Chain Analysis

Ethereum Taker Buy Sell Ratio (SMA 100)

The futures market has played a significant role in shaping Ethereum’s short-term price movements in recent years. Monitoring the sentiment of this market can provide valuable insights into Ethereum’s potential direction.

The Taker Buy Sell Ratio, with a 100-day moving average applied, tracks the relative aggressiveness of buyers versus sellers in the futures market. A ratio above 1 suggests bullish sentiment, while a ratio below 1 signals dominance of selling pressure.

While this metric has stayed above 1 for a prolonged period, it has recently begun to decline. This drop signals a reduction in buying pressure, and if it falls below 1, the market could experience a downturn as sellers take control.

This metric should be closely monitored over the coming weeks to determine whether Ethereum’s recent rally marks the start of a new bull market or if it is merely a temporary surge before another decline.