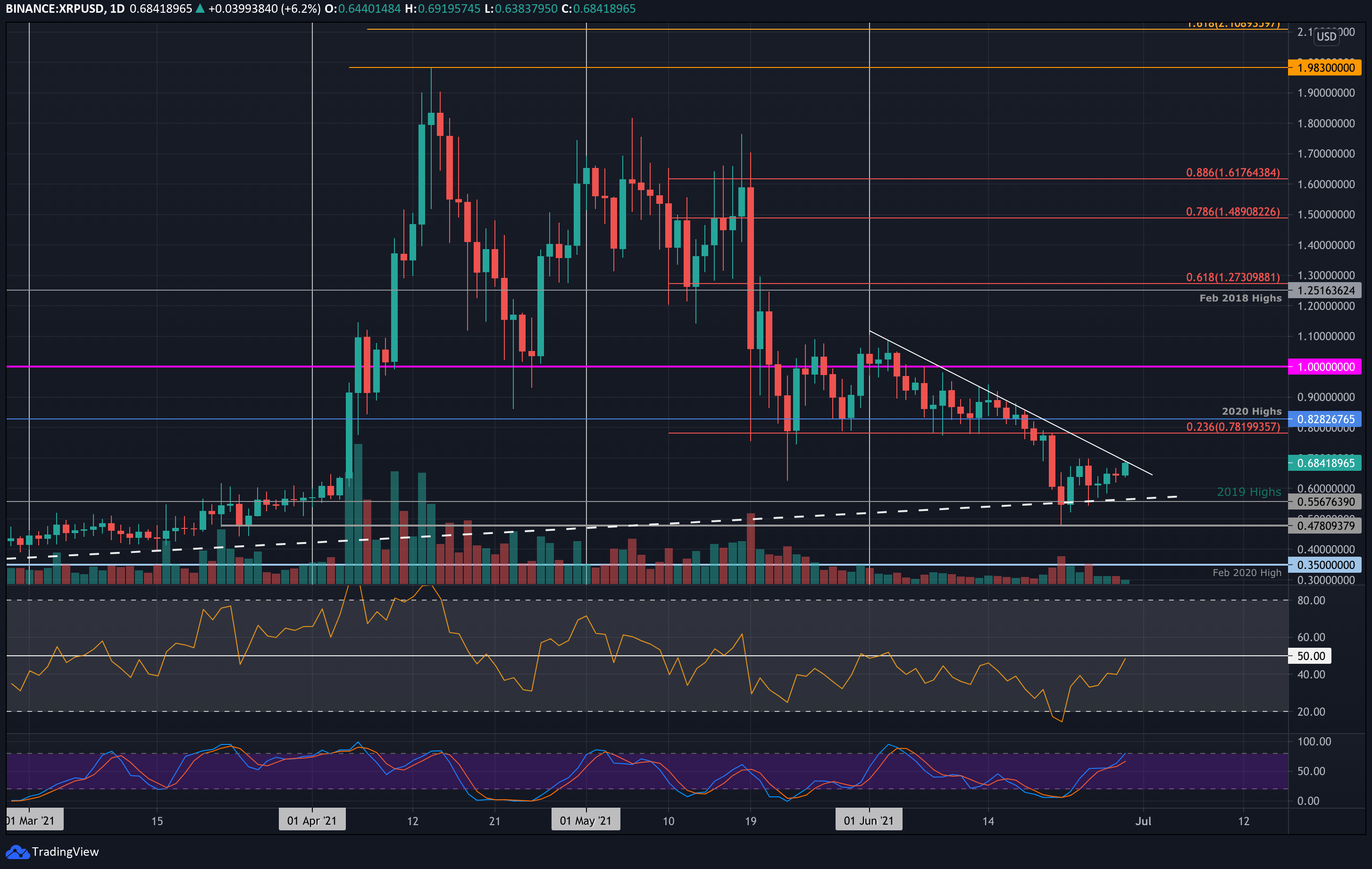

Ethereum has displayed strong bullish signals, with the price retracing above the crucial resistance level of $2.1K and maintaining its upward momentum. This led to a new annual peak of $2.4K, indicating renewed bullish sentiment and increased demand among market participants. However, it’s essential to note that short-term corrections typically follow a bullish surge. Ethereum encountered resistance at the upper boundary of the wedge, leading to a 10% decline. The divergence between the price and the RSI further supports the likelihood of a brief retracement before resuming its upward movement. In this scenario, the $2K support zone is expected to be Ethereum’s next target on the daily chart.

On the 4-hour chart, Ethereum’s upward momentum slowed upon encountering the $2.4K resistance zone and the upper boundary of the ascending wedge pattern. The expanded bearish divergence between the price and the RSI played a key role in triggering a substantial rejection.

Currently, Ethereum has reached a significant support region, with price levels between 0.5 ($2,211) and 0.618 ($2,166) Fibonacci levels and the static support level of $2K. A drop below these critical support zones could signal a more significant downturn in the market.

Despite the overall bullish sentiment and buyer dominance in the market, there is a notable possibility of a temporary consolidation correction phase in the short term, along with increased volatility.

Ethereum’s recent price surge has reignited expectations for a new long-term bull market. To gain further insights into Ethereum’s market outlook, it’s important to assess sentiment in the futures market.

Ethereum’s open interest is a key metric indicating the number of open perpetual futures contracts. Typically, higher values suggest increased volatility and the potential for bearish reversals, while lower values indicate a more sustainable trend. A gradual rise in open interest often aligns with bullish market phases. However, if open interest reaches elevated levels, it could signal a major market reversal. Although open interest has been rising, it has yet to reach levels seen during previous all-time highs. Consequently, while corrections are always possible, the futures market is still far from overheating. The current bullish trend, supported by moderate levels of open interest, is expected to continue in the coming weeks. Monitoring this metric will be crucial in anticipating any shifts in market sentiment and adjusting strategies accordingly.