Ethereum had a strong performance in 2021, reaching new all-time highs and solidifying its position as the second-largest cryptocurrency by market capitalization. However, looking ahead to 2022, the price trajectory is expected to face significant volatility. The strong rally observed in 2021 could be followed by a market correction, with Ethereum potentially experiencing price declines similar to Bitcoin. Despite the potential short-term downside, Ethereum’s long-term prospects remain solid due to its role as the backbone of decentralized finance (DeFi), NFTs, and its ongoing transition to Ethereum 2.0.

1. Ethereum’s Ecosystem and Network Developments

Ethereum’s fundamental strength lies in its decentralized applications (dApps), decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs). The Ethereum network continues to power much of the blockchain ecosystem, providing the foundation for numerous projects and innovations. However, Ethereum still struggles with scalability, high gas fees, and network congestion, which could impact its performance in 2022.

The much-anticipated Ethereum 2.0 upgrade, aimed at improving scalability and reducing energy consumption through a shift to proof-of-stake (PoS), continues to be delayed. While the upgrade promises long-term improvements, it has not yet been fully implemented, and scalability issues may continue to hinder the network’s growth in the short term.

In addition, Ethereum faces competition from other blockchain projects that offer lower transaction fees and faster processing times, such as Solana and Binance Smart Chain. This could lead to a reduction in Ethereum’s market share in certain sectors, especially if these alternatives continue to gain traction.

2. Ethereum’s Price Levels and Market Conditions

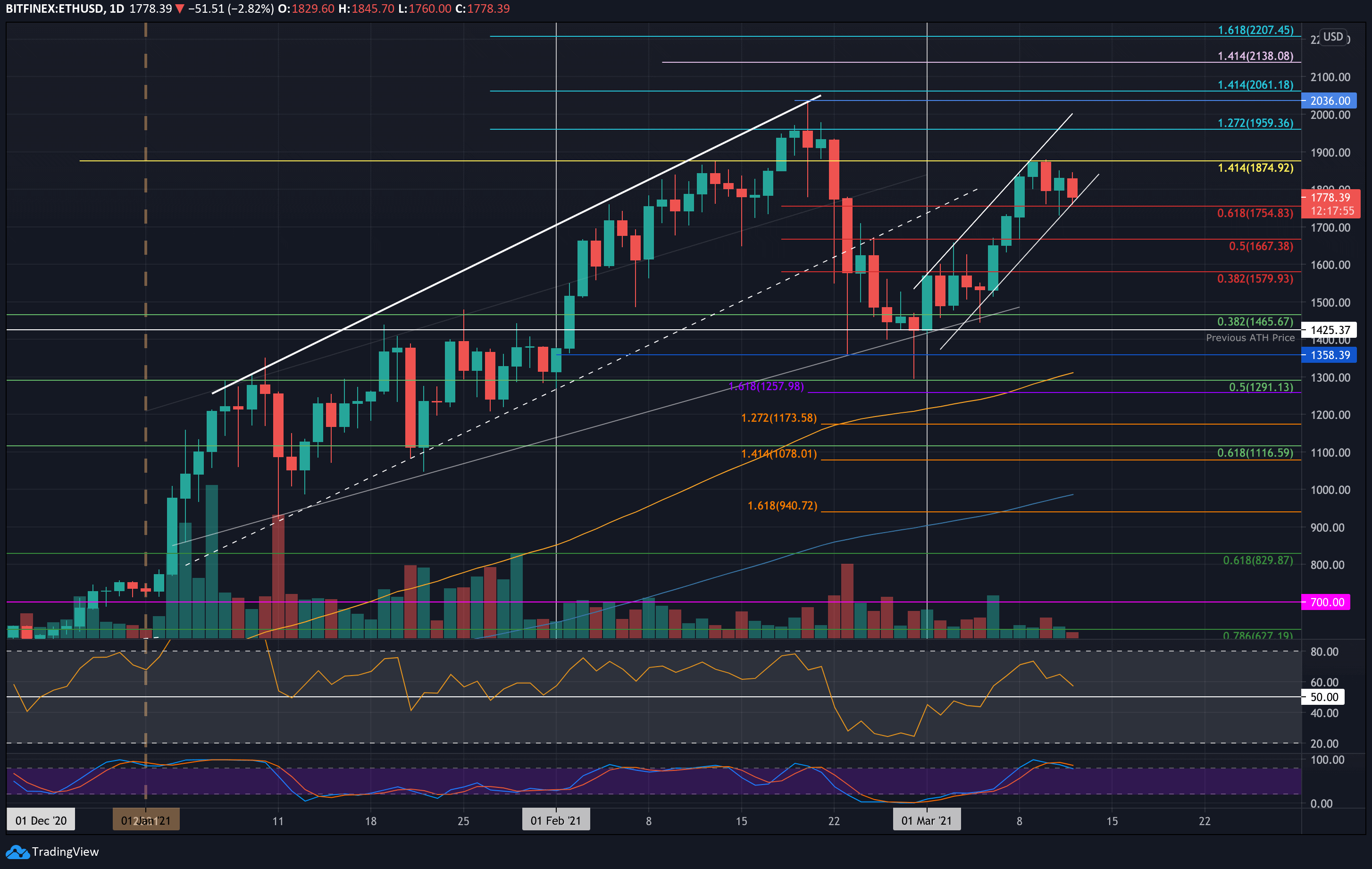

As of today, Ethereum was trading at around $4,000, down from its all-time high of approximately $4,800 in November. While Ethereum has experienced substantial growth over the past year, a pullback seems imminent given the broader market conditions. Ethereum’s price could face significant resistance at the $4,500 and $4,800 levels, and if these are not surpassed, Ethereum could experience further declines in 2022.

Key support levels for Ethereum are at $3,500, $3,000, and the critical $2,500 mark. If these support zones fail to hold, Ethereum could face a deeper retracement towards the $2,000 level. A prolonged bearish trend could even push the price below this level, which would likely present an opportunity for long-term investors to accumulate Ethereum at a more favorable price.

Ethereum’s price movements in 2022 will largely depend on the broader market sentiment, particularly the performance of Bitcoin, which tends to drive the cryptocurrency market. The tightening of global monetary policy, regulatory concerns, and broader macroeconomic factors could lead to a market-wide correction, further impacting Ethereum’s price.

3. Market Sentiment and Ethereum’s Competitive Landscape

Ethereum’s market position is still strong, but it faces increasing competition from other Layer 1 blockchain projects. As more developers and projects explore alternatives to Ethereum due to its scalability challenges, Ethereum will need to accelerate its improvements and focus on maintaining its dominance in DeFi and NFTs. However, even with the competition, Ethereum remains the leader in the DeFi space, which could help it maintain its value in the long term.

The adoption of Ethereum-based Layer 2 solutions, such as Optimism and Arbitrum, will also play a crucial role in reducing transaction costs and improving scalability. These solutions may drive demand for ETH, particularly as Ethereum becomes more efficient in handling decentralized applications. Nevertheless, Ethereum will need to ensure its Layer 2 solutions integrate seamlessly with its core network to continue attracting developers and users.

4. Price Predictions for 2022: Volatility and Potential Decline

Looking ahead to 2022, Ethereum’s price is likely to face downward pressure as the broader cryptocurrency market experiences volatility. A potential price correction could see Ethereum decline towards key support levels, with the price retesting the $3,500, $3,000, and even $2,500 zones. In a more bearish scenario, Ethereum could fall to the $2,000 range, marking a significant decline from its 2021 highs.

5. Short-Term Challenges but Strong Long-Term Outlook

While 2022 could bring a period of significant volatility for Ethereum, including potential declines in price, the long-term outlook for Ethereum remains positive. The challenges Ethereum faces, including scalability issues, high fees, and increasing competition, will need to be addressed in the coming years. However, Ethereum’s foundational role in the DeFi and NFT ecosystems, along with the eventual launch of Ethereum 2.0, positions it for continued growth in the future.

For long-term investors, the potential for a price decline in 2022 could present a valuable opportunity to acquire Ethereum at a lower price. Short-term fluctuations should be viewed as temporary, and those with a long-term perspective will likely be well-positioned for Ethereum’s future growth as the network continues to evolve and expand.