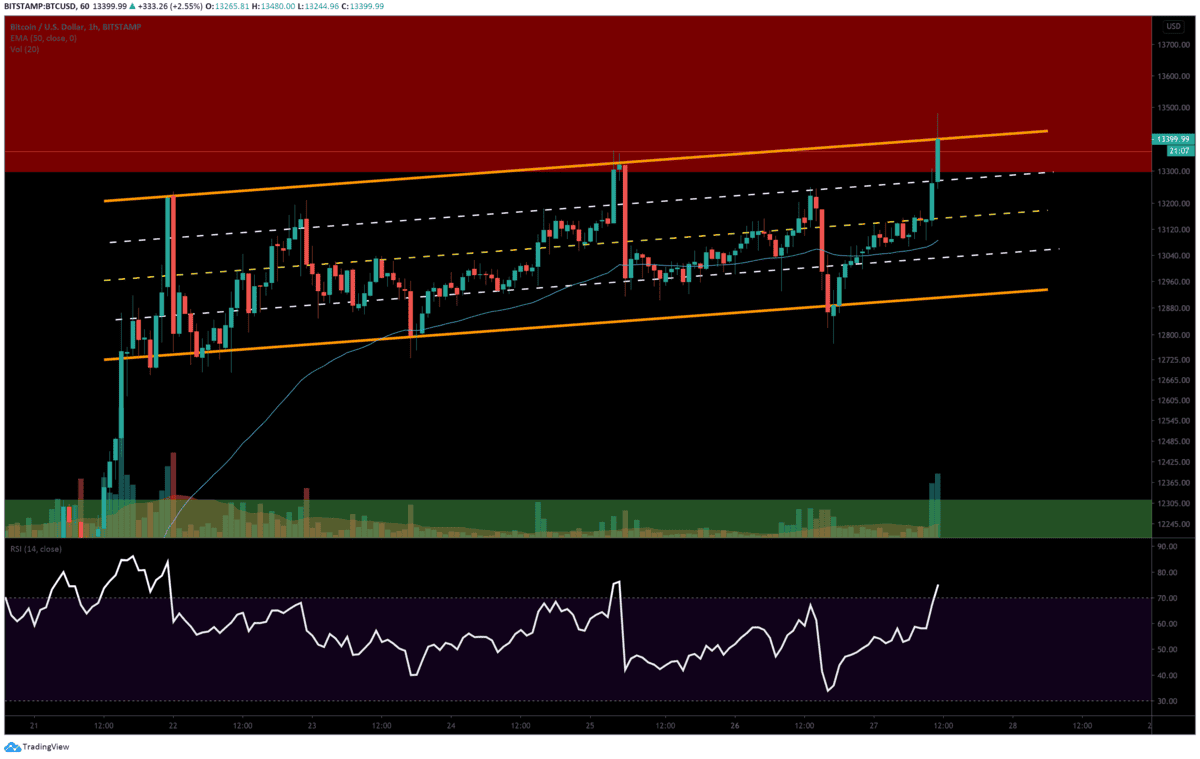

Ethereum is currently facing significant resistance around the $1300-$1400 range, with the 100-day and 50-day moving averages standing at $1360 and $1320, respectively. These levels have effectively capped the price’s upward movement, leaving Ethereum in a phase of consolidation with low volatility. The static resistance level at $1300 has been an obstacle for months, and Ethereum has formed a descending price channel, indicating a potential bearish trend if the key resistance zone is not cleared soon.

Technical Analysis: Breakout Needed to Revive Bullish Sentiment

The $1300-$1400 price region represents the most critical resistance area for Ethereum at the moment. A valid breakout above this range would likely restore bullish sentiment and lead to a fresh price rally. Without this breakout, Ethereum may struggle to gain upward momentum, continuing its consolidation phase with no clear direction. The static resistance at $1300 remains a barrier to further price appreciation, and the market’s overall lack of demand could lead to a reversal.

4-Hour Chart: Bearish Signals Emerge as Price Breaks Ascending Channel

On the 4-hour chart, Ethereum has broken below the ascending channel that had formed recently. The ascending channel is a well-known bearish reversal pattern, and unless Ethereum can break back inside this channel in the coming days, the bearish trend may intensify. The price is also facing resistance at the $1300 level. A break above this level would lead to the next resistance zones at the 0.5 and 0.618 Fibonacci levels, which are typically strong resistance levels in bearish trends.

Market Sentiment: Bearish Reversal Likely Without Demand

The current market sentiment remains concerning, as Ethereum is facing a lack of demand at its present price levels. This weak demand increases the chances of a bearish reversal, especially if the price fails to clear the critical $1300-$1400 resistance zone. If the bearish trend continues, Ethereum could see a significant decline toward the $1000 level, where additional support might be found.

Conclusion: Ethereum at a Critical Juncture

Ethereum is at a critical juncture, with its price consolidating below key resistance levels. The $1300-$1400 region is proving to be a major hurdle for bulls, and a breakout above this range is necessary to reignite bullish momentum. However, the current market’s lack of demand and the potential for a bearish reversal signal that Ethereum could face further downside if the price remains unable to break key resistance. Traders should watch for signs of a breakout or continued consolidation, as the next move could define Ethereum’s short-term price direction.